Transforming our supplier base

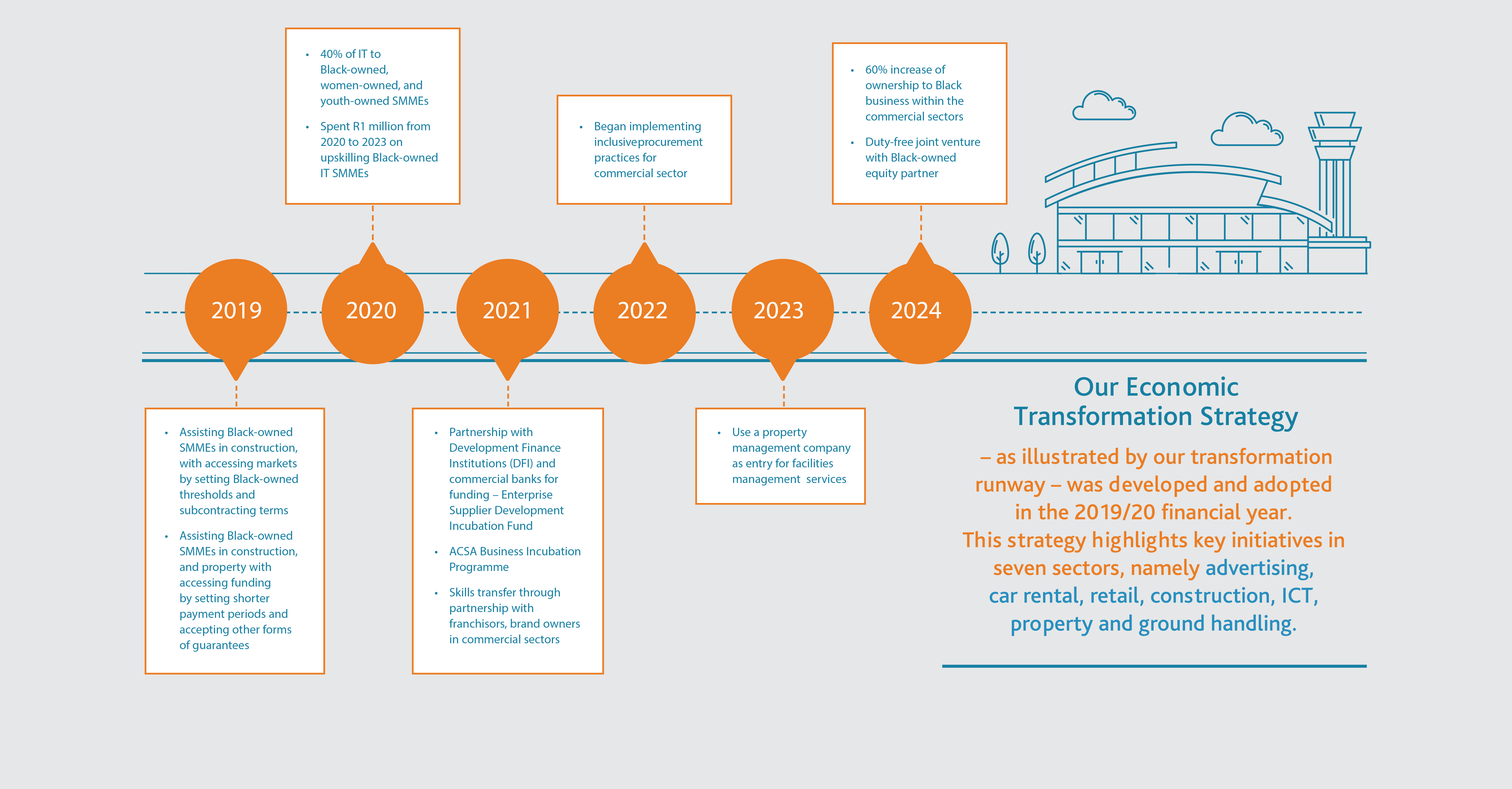

Our Economic Transformation Strategy – as illustrated by our transformation runway – was developed and adopted in the 2020 financial year. This strategy highlights key initiatives in seven sectors, namely advertising, car rental, retail, construction, ICT, property and ground handling.

Seven key sectors

Our strategies in the seven sectors we have identified are focused on preferential procurement and enterprise development. In the advertising, car rental and retail sectors, we engage in non-aeronautical revenue-generating commercial activities and contribute to the transformation of suppliers and service providers through various enterprise development initiatives.

In our ground handling operations, we do not engage in any commercial activities, but contribute to transformation by setting specific requirements in our ground-handling license agreements and by providing suppliers with access to enterprise development opportunities.

In the construction, IT and property sectors, we support transformation in our supplier base through the preferential procurement of goods and services, setting procurement performance targets that are monitored and reported on using a transformation dashboard.

Preferential procurement

At the start of the Covid-19 pandemic, we engaged with our suppliers about the impact it was likely to have on their businesses and ours. In particular, we identified the 20 top suppliers that could be at risk of having their B-BBEE ratings downgraded as a result of having to take measures in response to the various levels of lockdown.

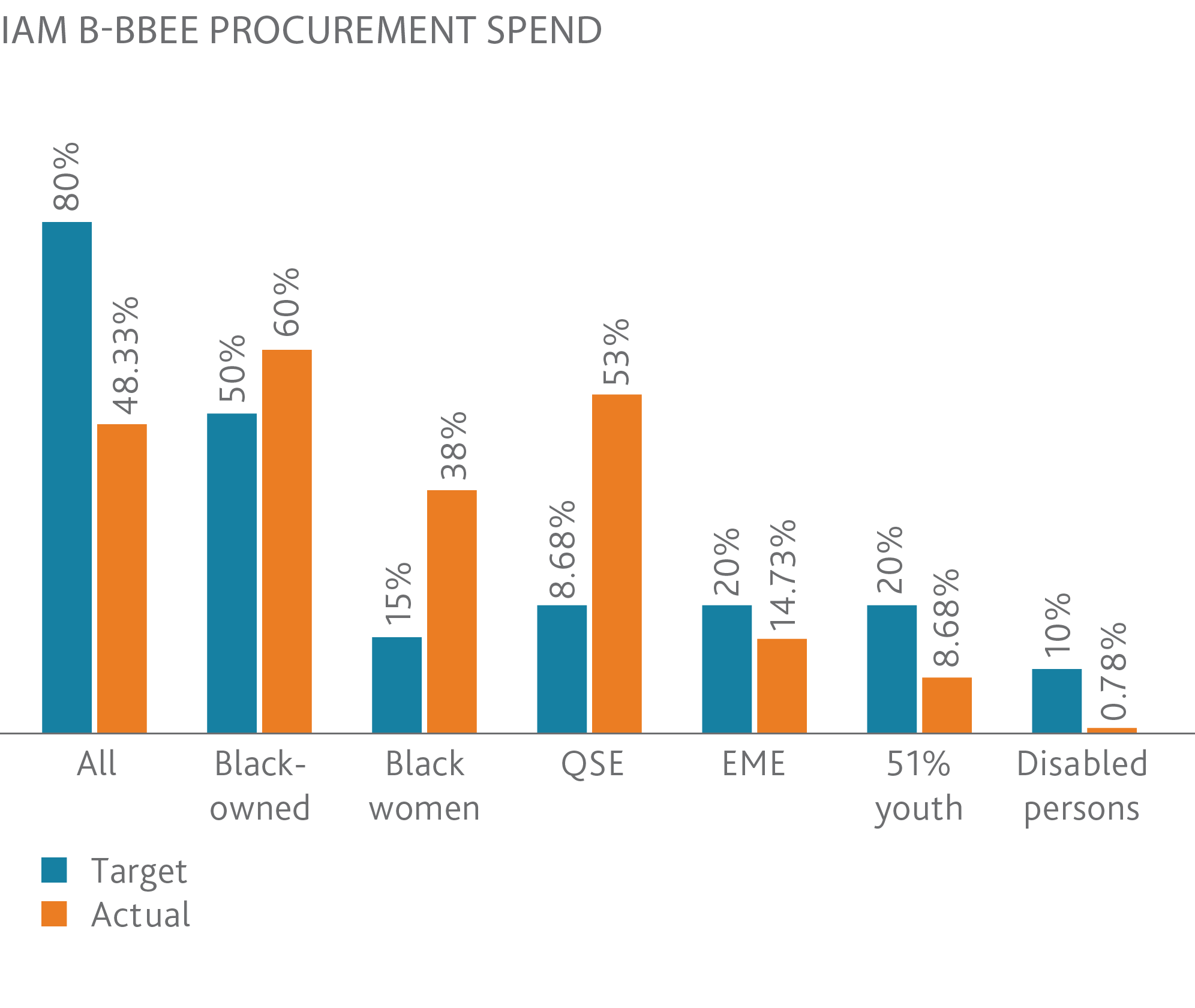

As part of our ongoing supplier performance monitoring process, we have actively engaged with all of our suppliers throughout the intervening period to ensure that they have been able to remain B-BBEE compliant. We have done this by using our transformation dashboard to monitor actual procurement spend against targets. A summary of our performance in the 2024 financial year is given in the table adjacent.

During the reporting period, our overall controllable procurement spend performance was R2.8 billion. This included R551 million spent on infrastructure. Of the overall spend, 74% (R2.08 billion) was spent with B-BBEE suppliers against a target of 80%, 68% (R1.4 billion) was spent with 51% Black-owned suppliers against a target of 50%, and 37% (R770 million) was spent with 30% Black women-owned suppliers against a target of 15%.

Further, R242 million of controllable spend was used to support exempt micro enterprises (EMEs), representing 11.63% of total spend against a target of 20%. R513 million was used to support qualifying small enterprises (QSEs), representing 25% of spend against a target of 20%; R187 million was used to support youth-owned enterprises, representing 9.01% of spend against a target of 20%; and R149 million was used to support enterprises owned and run by people with disabilities, representing 7.17% of spend against a target of 10%.

| B-BBEE procurement spend category | Target | 2024 | 2023 |

|---|---|---|---|

| For all suppliers |

80% |

76.92% |

74.72% |

| From 50% or more Black-owned suppliers |

50% |

65.00% |

70.00% |

| From 30% or more Black-women suppliers |

15% |

39.00% |

38.00% |

| From QSEs |

20% |

23.00% |

23.00% |

| From EMEs |

20% |

9.86% |

11.12% |

| From 51% youth-owned companies |

20% |

6.78% |

5.15% |

| From people with disabilities-owned companies |

10% |

7.78% |

8.63% |

Our revised flagship projects in the construction, IT, operations, security and commercial sectors have remained a priority and have enabled us to meet our procurement targets. Despite budget constraints, we have been able to continue contributing to economic transformation through these projects.

By the start of the new business cycle in the 2024 financial year, we had regained a firm recovery position although passenger traffic was below forecast. With the uncertainties of both the local and global market in mind, we undertook a full review of our capex programme and put a revised development plan into place for the period to 2032.

We have adopted a conservative approach to reinstating capacity projects and those that were approved for reinstatement had to go through the necessary planning stages before we could proceed to procurement.

Construction

As we entered the 2024 financial year, we had Board permission to restart terminal expansion and modification projects at Cape Town International Airport, Chief Dawid Stuurman International Airport in Gqeberha (previously Port Elizabeth) and King Phalo Airport in East London. We also had permission to reinitiate the refurbishment of the cargo precinct at OR Tambo International Airport in Johannesburg and the refurbishment of the runways at Bram Fischer International Airport (Bloemfontein) and Kimberley Airport. Planning on another flagship project, a new midfield cargo terminal at OR Tambo International, was also resumed and an assessment phase was undertaken. This R5.7 billion project will contribute to socio-economic transformation in many ways, not least through job creation and the promotion of trade. Construction work on the project will resume in the 2025 financial year and R3 billion of the total budget will be disbursed during the year. Also, at OR Tambo International, we are in the process of doing the necessary assessments for a midfield passenger terminal complex, for which there is a construction budget of R15 billion. Work on this complex is scheduled to take place during the 2028 to 2032 business cycle. Already in progress is an extension to the international bussing station at the airport, for which there is a budget of R245 million.

At Cape Town International, four infrastructure projects are in various stages of development. Construction work on three of these will take place during the current business cycle. They include the construction of extensions to the domestic departure lounge and gates, for which there is a budget of R388 million; the construction of a new domestic arrivals terminal, for which there is a budget of R1 billion; and the realignment of one of the runways, for which there is a budget of R6 billion. The redevelopment of Terminal 2, for which there is a budget of R4.3 billion, is currently in the planning stage and construction will take place in the next business cycle.

Key infrastructure development projects are also in various stages of development at Chief Dawid Stuurman International, George Airport and King Phalo Airport. These have a total development budget of R1.92 billion.

The purpose of these projects is to maintain our assets in such a way that we are able to retain our license to operate as well as provide safe airport operations and a seamless passenger and airport user experience. A further 78 corporate projects are in various stages of implementation and have a budget of R5.27 billion.

Finally, in line with our strategic objectives, we are investing heavily in energy and demand management projects. In particular, we are currently extending our energy demand management and solar PV solutions at OR Tambo International, King Shaka International (Durban) and Cape Town International. The total construction budget for these three projects is R1.06 billion. We are also in the planning stage for a gas-topower trigeneration plant, which is scheduled for construction between 2027 and 2032. The budget for this project is R2.034 billion.

Information Technology

Current performance on all contracted projects is in line with our IT transformation targets. The process of digitalising outdated or redundant processes is ongoing and the digital roadmap that was defined to support our organisational strategy includes a capital expenditure budget of R1.2 billion for the five years to the end of the 2025 financial year.

During the reporting period, we spent R49 million (2023: R224 million) on executing projects outlined in the roadmap. These are concerned with improving the passenger and airline experience, enhancing cybersecurity, updating our IT infrastructure and automating core business processes. Detailed information about these projects is given in the Performance Review section of this report.

Strategic projects such as the design and implementation of the passenger self-service programme, Common-Use Self-Service (CUSS) kiosks, commercialisation initiatives and parking equipment will provide secure, innovative and resilient digital platforms to meet customer expectations and deliver on our B-BBEE commitments.

R560 million of the IT budget for the reporting period was spent with Black‑owned companies; 25% with companies owned by Black women, 15.24% with QSEs, 0.03% with companies owned by Black youth and 22% with companies owned by people with disabilities. Of the total spend on Black businesses, R379.34 million was OPEX and R181 million was capex.

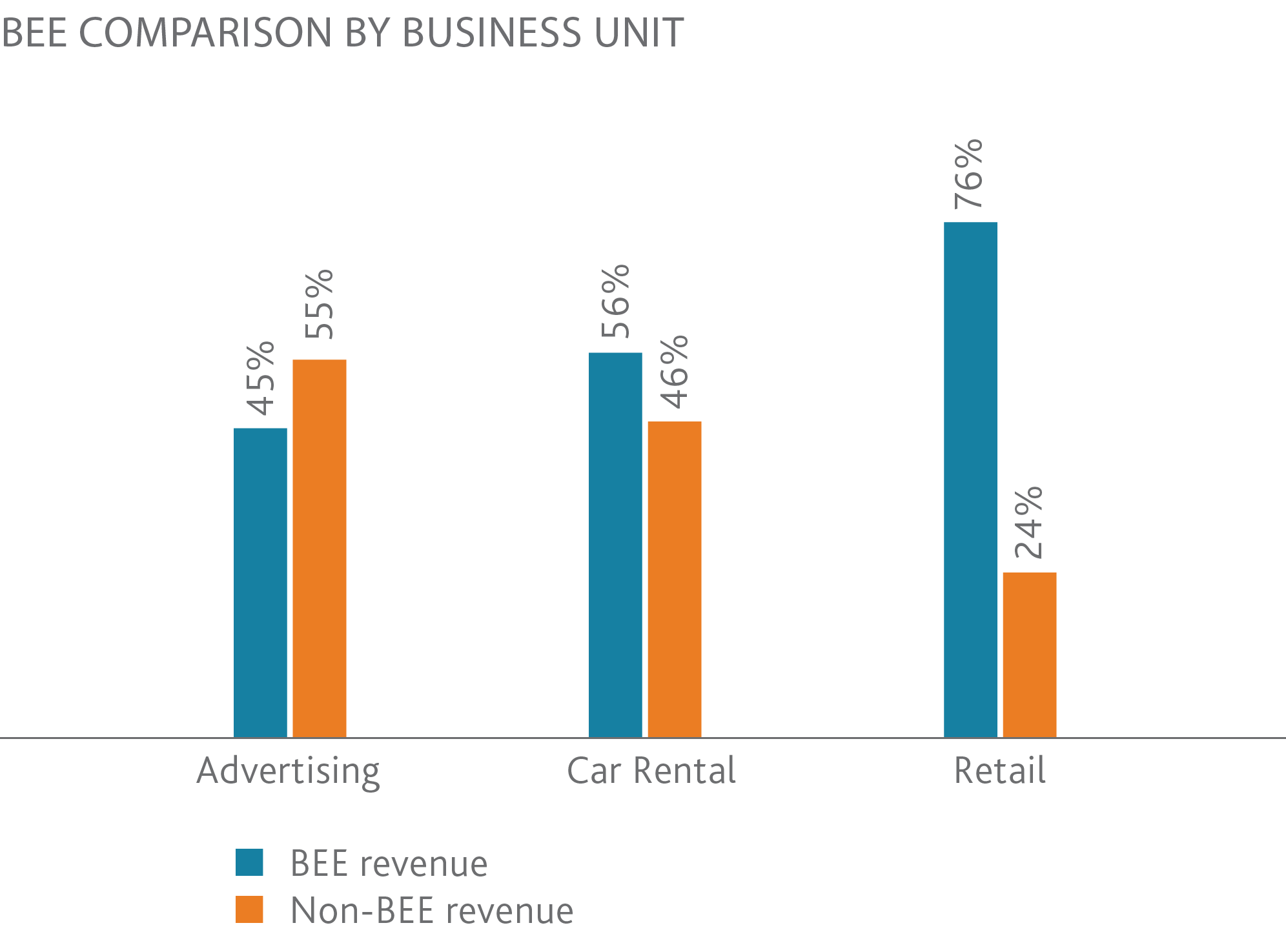

Commercial

The Commercial division’s priority is to ensure successful transformation through the share of Black business in commercial revenue generation. In the 2024 financial year, Black-owned businesses contributed 68% of ACSA’s commercial revenue against a target of 55%, largely due to a recent empowerment transaction by the Core Duty Free operator. A breakdown of procurement by revenue source is given below.

Ground handling

ACSA issues licenses to companies that provide services to aircraft on the airside. Licenses are issued to provide catering services to aircraft, airline self-handling, ground handling services and aircraft technical maintenance services.

During the reporting period, 16 airside licenses were issued to service providers, three of which were not B-BBEE compliant. Processes to address non-compliance with the other two service providers.

All service providers are continually engaged to encourage them to improve their B-BBEE status.

Enterprise development

Our enterprise supplier development initiatives support not only large companies, but SMMEs as well. We include SMMEs in our supplier base and provide both financial and non-financial support for them to increase economic participation and stimulate job creation. This, in turn, supports the growth and sustainability of the aviation sector while also advancing our own transformation objectives.

With our support, SMMEs can grow into scalable businesses that have the potential to become part of our supplier development programme and, ultimately, to become preferred procurement partners.

During the course of the year, our Socio-Economic Development Strategy and Policy was updated and, with the input of both internal and external stakeholders, was further aligned with our procurement objectives. The revised strategy defines our procurement objectives as well as our enterprise and community development objectives for the 2025 financial year.

The following table gives a summary of our key enterprise development initiatives in the 2024 financial year:

| Programme | Partners | Activity |

|---|---|---|

| Entrepreneur ‘Giving it Wings’ Programme |

Mangaung Chamber of Commerce and Industry (MCCI) iLembe Chamber of Commerce and Tourism (iLembe) |

‘Giving it Wings’ is an extension of the Entrepreneur Programme already running in KwaZulu-Natal and around George in the Western Cape. Engagements were held to socialise the programme and expand the enterprise development business accelerator programme into Free State under the stewardship of Bram Fischer Airport. The programmes provide an opportunity for SMMEs in the Mangaung district especially Botshabelo, Thabanchu, Brandfort, and Ladybrand areas to grow their business through the business accelerator programme. |

| ACSA-dtic Black Industrialist Programme | Department of Trade, Industry and Competition (dtic) |

The dtic has established the Black Industrialist Programme, which promotes the growth and competitiveness of Black-owned and -managed enterprises in the manufacturing sector. As an SOC, our role is to participate in this programme through our procurement and supplier development mechanisms. Emphasis has therefore been placed on the need ensure that Black manufacturers have access to markets and on facilitating supplier development initiatives. Luggage trolleys, in particular, have the potential to be part of the suite of products that can sustain the local manufacturing sector and create much-needed jobs. |

| ACSA-DTIC Black Industrialist Programme Open Days |

Department of Trade, Industry and Competition (dtic) Industrial Development Corporation (IDC) |

In June 2022, ACSA and its partners established a working group on localisation. This was formed to ensure that ACSA can leverage public procurement to build domestic manufacturing across various sectors. The Black Industrialist Programme was highlighted as a channel to address some of the procurement challenges within our value chain. Black Industrialist Open Day activations were therefore identified as an intervention that could be used to expose local manufacturers to our procurement value chain. Open days were successfully hosted in KwaZulu-Natal, Eastern Cape and Western Cape and the programme is ongoing. |

© Copyright 2024 ACSA