Develop airports

Overview

Developing world-class airport infrastructure that is designed to meet the needs of all airport users and is aligned with industry requirements supports our vision of being a world-leading airport business.

Prior to the Covid-19 pandemic, when many of our airports were operating at or near design capacity in peak hours, large capital investment projects were planned for capacity expansion and efficiencies. However, with the onset of the Covid-19 pandemic, we had to reassess our entire capital development programme and only projects that had already been contracted remained in progress during the Covid-19 pandemic and in the immediate post-pandemic period.

As we have now reached a relative recovery position in line with our strategy, priority has been given to projects that:

- protect the airports’ licenses to operate;

- provide a safe, efficient and attractive environment for passengers and other airport users;

- mitigate risk;

- ensure that facilities remain compliant with regulations; and

- allow for equipment to be replaced when we have been unable to secure an operating baseline through overhauls and/or intensified maintenance.

Larger infrastructure projects that have been on hold since 2020 and are now in progress again include:

- the terminal refurbishment and expansion projects at all seven airports;

- the refurbishment of the cargo precinct at OR Tambo International;

- the expansion of the international bussing station at OR Tambo International;

- the planning for a new midfield cargo terminal at OR Tambo International;

- the realignment of the runway at Cape Town International; and

- the refurbishment of the runways at Bram Fischer International Airport in Bloemfontein and Kimberley Airport.

We remain committed to improving and expanding the infrastructure in our portfolio in order to unlock both the commercial and development potential inherent in our airports and to grow footprint, especially in Africa. We anticipate that this will deliver significant socio-economic benefits at both national and regional level.

Enterprise project management

Our capital investment programme is managed through our Enterprise Project Management Office (EPMO), which enables us to evaluate and respond to business and financial challenges in a structured and centralised way. The budget for the programme, which provides for over 1 500 projects, is R10 billion over the next three years of the Corporate Plan period, and it allows for the reinstatement of many projects deferred during the Covid-19 pandemic. Capital allocation targets are set at enterprise level and replacement, refurbishment and safety-critical projects are prioritised.

The EPMO has developed and implemented a standardised enterprise project management environment and uses a set of 32 project management frameworks to define the roles and functions that support its lifecycle management methodology. These align all project management office functions and gate controls across IT, maintenance, engineering, security, major infrastructure and fleet. As a result, our project management maturity has improved significantly over the past four periods, resulting in greater efficiency and better cost containment. An online enterprise project management solution has also been developed to provide for the continuous improvement of project management skills and capacity.

Infrastructure planning

Airport master plans that are closely aligned with our overall business strategy are crafted for each airport and take into account municipal spatial development frameworks and plans. They address the integration of airport development into the local authority’s broader spatial development plans and more needs-specific plans such as integrated transport plans.

An airport master plan is an expression of a vision for the ultimate development of an airport. It is a road map for efficiently meeting aviation demand in the foreseeable future while also preserving the flexibility necessary to respond to changing industry conditions. Master plans also consider infrastructure enablement such as bulk services, access routes and environmental conditions.

At ACSA, we have adopted an integrated approach to airport planning and development, which is expressed in our Aerotropolis and Airport Cities Strategy. An aerotropolis or airport city is an urban area or city centred around an airport, with the airport fulfilling multiple functions.

In terms of this strategy, our aim is to define specific critical success factors for each airport, to support these by creating enabling conditions, and to identify appropriate developments, projects and initiatives for that airport. The master plan for each airport identifies the kind of infrastructure needed at that location, defines the precincts within the airport where that infrastructure is needed, allows for detailed development plans for areas such as the terminal precinct and the cargo precinct, and provides for the implementation of individual projects, such as terminal buildings, parkades or aircraft stands.

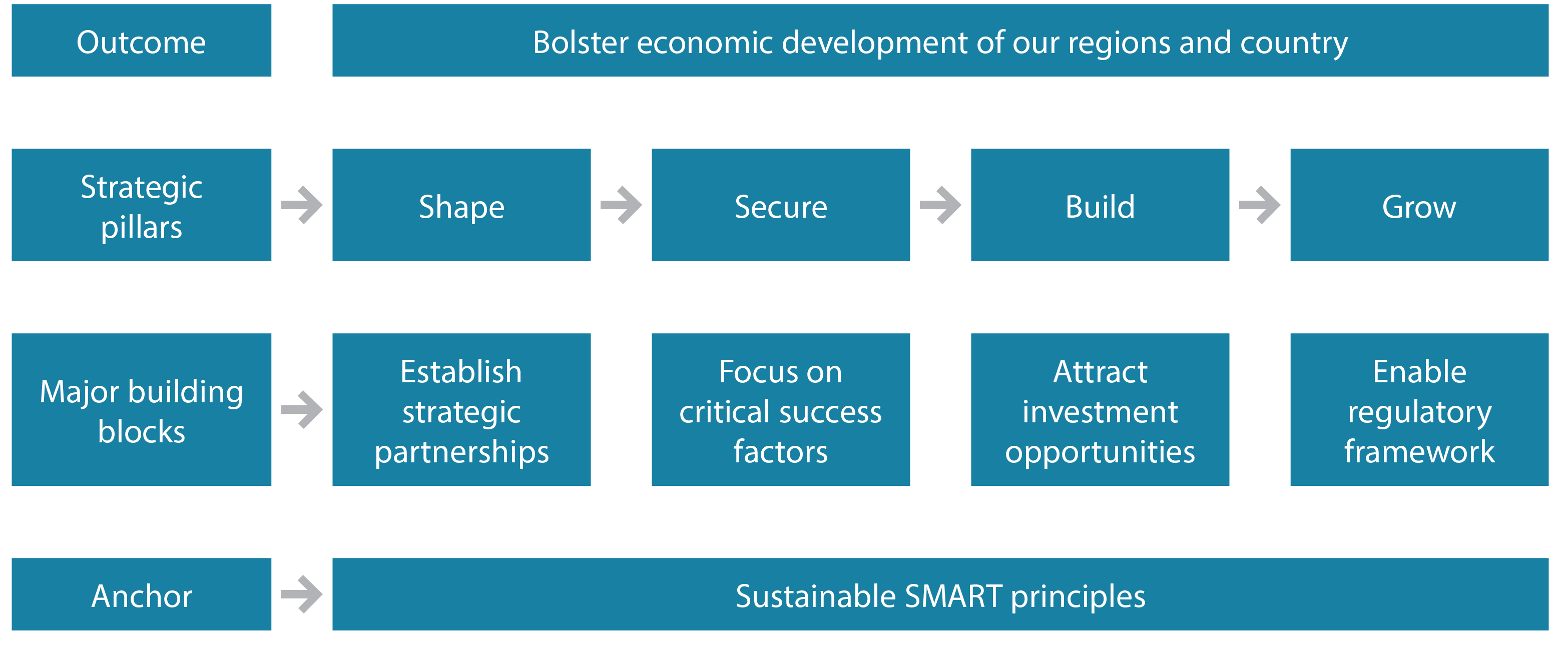

The aim of the Aerotropolis and Airport Cities Strategy is to promote economic growth and development for the benefit of the Group, the regions in which the airports operate and the country as a whole. On a macro-economic level, it is aligned to the goals of the NDP and, from a business perspective, it is intended to improve our competitiveness, maximise revenues, improve the accessibility of our airports, and promote connectivity between airports and regional hubs.

The vision for our aerotropolises and airport cities is to attract smart, relevant aviation and non-aviation development to our airports in order to diversify our income streams and, ultimately, to secure our long-term sustainability.

The execution of this strategy depends on several critical success factors, namely strategic partnerships in both the public and private sectors, suitable investment opportunities, the availability of adequate capital budget, an integrated approach to project planning and implementation, and a responsive regulatory framework.

To date, aerotropolis master plans have been concluded for the City of Ekurhuleni, where OR Tambo International is located, and the City of Durban, where King Shaka International is located. In addition, an aerotropolis feasibility study has been conducted for the City of Cape Town and the outcomes of this are being used to inform our strategy for that airport and the Western Cape regional hub.

Innovation plays a pivotal role in realising our Aerotropolis and Airport Cities ambitions, as well as advancing the continent’s regional integration endeavours.

Our Innovation strategic pillar is designed to leverage evolutionary, breakthrough and revolutionary innovations across all aspects of our operations. This approach recognises the diverse requirements for innovation within our business ecosystem, ensuring adaptability and effectiveness in achieving our strategic objectives:

- Our approach to fostering innovation is rooted in the strategic utilisation of our existing knowledge assets through the implementation of advanced knowledge management systems. This includes strategic integration of emergent technologies to harmonise with prevailing digital trends in airport business operations. We continue to systematically assess and prioritise innovation endeavours in accordance with fundamental business imperatives such as cost reduction, productivity enhancement and increased customer satisfaction.

- Consequently, we have embarked on various initiatives aligned with these imperatives, such as the deployment of a self-service programme consistent with the IATA Fast Travel initiative. The goal is to provide passengers with an expanded array of automated and touchless services, accessible through online platforms, our dedicated application or on-site facilities at our airports. Moreover, we are exploring other key passenger facilitation technologies such as biometric identification systems, to fortify airport security measures and streamline passenger processing.

- Furthermore, we have instituted a spectrum of energy efficiency measures across our infrastructure portfolio, encompassing the establishment of active solar farms at select airports, alongside initiatives harnessing geothermal, gas, wind and waste-to-power resources. These endeavours not only contribute to mitigating our carbon footprint but also bolster our resilience by reducing our reliance on national power grids. The overarching objective is to transition all operational facets off-grid in the long run.

- Additionally, we are committed to maintaining ISO 14001 carbon accreditation across all our airport facilities, as certified by ACI.

Property development and asset management

Property development

The property development division aims to maximise ACSA’s real estate value, which includes vacant land in and around our airports. This is done through the development of infrastructure to unlock opportunities that are adjacent and complementary to our core business of running airports. Typical investments include conference facilities, transportation nodes, cargo facilities, office parks and logistics platforms to name a few. The property portfolio plays a crucial role in the airport business, as the revenues generated help reduce or offset the cost of airport operations. This leads to more competitive charges for airline operators, ultimately benefiting travelers.

As previously mentioned, infrastructure projects deferred in 2020 are now being revisited and prioritised. We are focusing on incubating projects in general aviation, aircraft services and facilities for travelers. Most projects that were in progress at the time have now been completed.

These include certain refurbishment projects and ACSA’s new office park at OR Tambo International. The 33 000m2 Aviation Park campus comprises three buildings, the first of which is used by ACSA as its head office, while the other two form part of our rental property portfolio.

A world-class facility, the campus has been granted a four-star rating for sustainable building design by the Green Building Council of South Africa. This relates in large part to the use of energy-efficient infrastructure, which features primary lighting by natural light, occupancy sensors to minimise electricity usage, the use of rainwater harvesting, and vegetated areas to promote natural thermal inertia. There is also a sophisticated building management system in place, which ensures all the sub-systems of the building are working in harmony to achieve the most efficient and sustainable outcomes.

Aviation Park is the first major infrastructure development project we have undertaken in the past ten years and is testimony to our ability to manage projects of this size.

Enterprise Asset Management

Enterprise Asset Management is a function tasked with managing ACSA’s infrastructure and assets throughout their lifecycle. This encompasses the responsibility for optimising the return-on-asset levels through safe and relevant engineering practices as well as technology selection that is suitable for an airport environment. The division continues to ensure that infrastructure and operations are scaled to passenger traffic at an acceptable cost.

To achieve this, we are guided by our maintenance regime standards for core, key and supporting assets. This ensures the safety of airport operations and compliance with regulatory standards. The following table indicates how our assets and technologies are categorised:

CATEGORISATION OF VARIOUS ASSETS AND TECHNOLOGIES| Category | Examples of assets/technology classes | ||

|---|---|---|---|

| Core assets | |||

|

Without these assets ACSA will experience business interruptions with the possibility of a downgrade or airport closure due to noncompliance. |

|

||

| Key assets | |||

|

An airport can operate without these assets for between eight and 48 hours if they are unavailable. |

|

|

|

| Supporting assets | |||

|

We are able to sustain the business without these assets and unavailability will have a minimal impact on operations. Rectification would, however, be needed to sustain the integrity of the ACSA brand. |

|

|

|

The ability to achieve and sustain reduced cost baselines during and after the Covid-19 pandemic has been attributable to:

- Implementation of a revised service catalogue for maintenance services, bundling similar services to reduce the required full-time equivalents and align contract specifications with the maintenance regimes. This output-based service contracting approach will continue as part of our maintenance programme.,/li>

- Critical review and identification of maintenance activities that can be performed by in-house artisans and other technical teams, including weekly generator on-load testing and asset inspections. This is a process of deciding which maintenance activities can be performed by in-house artisans and technical staff (e.g. weekly generator on-load testing and asset inspections). Ongoing tooling, training and development have enhanced the technical skills and equipment knowledge of first-line maintenance staff.,/li>

Additionally, we have implemented an in-house asset assurance programme to ensure the maintenance regimes are completed on time and meet quality and regulatory standards. For quality assurance tasks that require certified inspectors, such as lift or refrigeration inspections, certified professionals are employed.

Ongoing budget constraints impact our asset management function; thus capex projects are prioritised based on safety and risk, recurring and/or single points of failure, end of life, technology obsolesce, and modernisation.

To address the backlog in infrastructure maintenance and development caused by the Covid-19 pandemic, we are implementing a rolling capex programme, that was developed in consultation with the aviation industry in January 2020. This programme involves cyclical renewal of infrastructure and assets using standard, replicable processes, reducing duplication in engineering design and accelerating execution based on lessons learned from previous projects.

We are also engaging specialised services that were deferred during the Covid-19 pandemic. These services, which are necessary for compliance with regulations and the Asset Management Strategic pillar, include bulk services planning, fuel master planning, corrosion engineering, energy performance certification, fuel infrastructure rehabilitation costs for NERSA applications, and infrastructure condition monitoring.

Outlook

Despite exceeding our performance expectations for the year, we remain cautious due to the volatile macro environment, marked by ongoing geopolitical tensions that negatively impact growth. With inflation expected to slow down in the second half of 2024, which may provide relief for consumers, potentially boosting air travel and spending.

ACSA is encouraged by the passenger traffic recovery rate across its network, currently at 88%. Although this is four percentage points below the ACI global passenger forecast of 92%, which exceeds the pessimistic forecast scenario of 83%.

Our corporate plan focuses on generating and delivering sustainable growth as we move into the next phases of our strategy, driven by innovation. Key initiatives include revitalising infrastructure to enhance airport efficiency and user experience, supported by a capex commitment of over R10 billion throughout the corporate plan period.

We are prioritising retaining and attracting key talent by addressing our workforce's needs and adapting to the competitive global workforce landscape. Enhancing collaboration with stakeholders within the airport ecosystem is crucial for fostering seamless operations, enriching the user experience and advancing growth and sustainability objectives.

We have strategically allocated resources to ensure the smooth implementation of our strategy and the R21.7 billion capex permission granted by the Economic Regulator. Furthermore, in the next three to six years we will be focusing on cargo and logistics development with plans for the Midfield Cargo Terminal and restructuring of our business and operational model to align with opportunities presented by the AfCFTA.

These efforts aim to bolster our resilience and position ACSA for continued success in a dynamic macro environment.

© Copyright 2024 ACSA