MESSAGE FROM THE CFO

The 2024 financial year was marked by a significant recovery in international and domestic traffic volumes, resulting in improvements in all key financial metrics. ACSA has shown remarkable agility and resilience in overcoming the challenges of the past four periods and remains committed to adapting and thriving in a rapidly changing environment.

Mr Luzuko Mbotya Chief Financial Officer

While ACSA had to face many challenges during the reporting period, I am pleased to be able to present positive results for the financial year ended 31 March 2024. Our consolidated Annual Financial Statements, on which this report is based, were prepared in accordance with the Public Finance Management Act (No. 1 of 1999, as amended), the Companies Act (No. 71 of 2008, as amended), the King Report on Corporate Governance for South Africa™ (2016) (King IV™) and the JSE Debt Listing Requirements.

The Group achieved a notable improvement in all of its financial metrics, most notably reporting increases in both revenue and earnings before interest, tax, depreciation and amortisation (EBITDA). Revenue increased by 16% to R7.0 billion (2023: R6.0 billion) and EBITDA increased by 51% to R2.9 billion (2023: R1.9 billion). Profit before tax increased to R1.5 billion compared to a loss of R246 million in the previous period. This performance was largely attributable to the ongoing recovery in both international and domestic passenger traffic, increased cargo volumes, and the prudent management of operating and employee costs. We also maintained a solid financial position with total assets of R31.4 billion, slightly lower than the R31.8 billion at the beginning of the financial year due to a reduction in fixed assets.

These results are testament to the success of the Recover and Sustain Strategy and the revised Financial Plan that we put into place as a first response to the Covid-19 pandemic. They are also testament to the dedication of our Board, Executive Committee, Group Executives, management and staff, who have worked tirelessly and with dedication to restore the business to normal operations after the impact of both the Covid-19 pandemic and subsequent geopolitical events.

Having achieved a strong post-pandemic position, we are now able to focus on innovation, growth and sustainability rather than on recovery. We remain committed to our long-term goals, as expressed inn our vision and mission, and will continue to adapt and thrive in response to evolving market demand and supply conditions.

Revenue

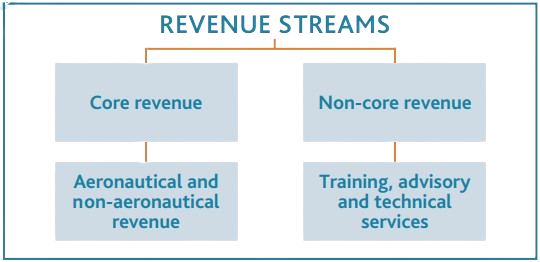

As indicated in the ‘Group overview’ section of this report, ACSA has three sources of revenue: our core aeronautical revenue, which is derived from airport operations and regulated tariffs; non-core revenue, which is derived from various commercial income streams; and non-core revenue, which is derived from the provision of technical advisory and consultancy services as well as from the training delivered through the Training Academy.

Aeronautical revenue increased by 21% to R3.6 billion (2023: R3.0 billion) during the reporting period, resulting from an 8% increase in airport movements, a 16% increase in the number of departing passengers, and the implementation of an inflationary increase of 4.4% on tariffs.

Similarly, non-aeronautical revenue increased by 12% to R3.4 billion (2023: R3.1 billion), reflecting a significant improvement in trade conditions. The bulk of this revenue was derived from retail rentals, which increased to R1.1 billion from R848 million in the previous period.

Revenue from non-core activities also showed remarkable improvement, with the Training Academy, in particular, exceeding target by 125% and closing the year on R5.4 million.

Employee expenditure

From an expenditure point of view, talent acquisition received special attention throughout the year as we set out to fill vacancies created by the Staff Cost Reduction Programme that was introduced in the 2020 financial year. We were also in a position to restore and enhance employee rewards and benefits, surpassing pre-pandemic levels.

Employee expenditure therefore increased by 27% to R1.6 billion (2023: R1.2 billion), primarily due to an increase in headcount and the payment of an ex-gratia bonus amounting to R75 million to all employees, including executive management. An incentive bonus of R117 million, based on 4% of company EBITDA, has also been provided for.

Other operating expenditure increased by 6% to R2.5 billion (2023: R2.4 billion), with the primary contributing factors being increases in maintenance, security, utilities and information systems costs related to the full reopening of airports and supporting services. R198 million tax expenditure recognised in respect of the 2018 to 2020 additional assessments, also contributed to the increase.

Property, plant and equipment

Capital expenditure for the year amounted to R551 million (2023: R422 million). This was attributable to ongoing airport maintenance, the reinstatement of our refurbishment and rehabilitation programme, and expenditure on efficiency and technology related projects. The value of the property, plant and equipment portfolio decreased to R15.9 billion (2023: R16.7 billion), primarily due to wear and tear as well as minimal expenditure on improvements and additions over the preceding four periods.

Investment properties

The value of investment properties increased to R7.9 billion (2023: R7.7 billion) as at 31 March 2024 due to a fair value gain of R243 million (2023: R209 million loss). This was primarily as a result of improved trading conditions as well a slight improvement in the number of new leases taken up. In turn, this is indicative of continuing recovery in the commercial property market over the past two periods.

Trade and other receivables

Trade and other receivables closed with a balance of R1.7 billion (2023: R1.7 billion), largely due to an improvement in debtors’ collections. Cash from operations collected during the financial year amounted to R7.8 billion (2023: R5.8 billion). We did, however, write off R88 million in irrecoverable debts (2023: R463 million).

Further, the impairment provision has been reduced to R419 million from R456 million in the previous period as a more positive economic outlook is expected to result in improved trading conditions and greater volumes of passenger traffic. We also expect to be able to collect historic debt accumulated during the Covid-19 pandemic.

Funding

Cash and cash equivalents, excluding short-term investments, increased by R667 million to R2.9 billion by 31 March 2024. This was largely due to cash inflows of R3.6 billion generated from operations and R272 million derived from interest income. A dividend of R664 million was also accrued on preference shares. The Group anticipates paying dividends on these shares during the 2025 financial year subject to compliance with a liquidity and solvency assessment.

Further, the Group repaid R2.1 billion in debt, most notably by repaying the AIR02 bond and the INCA and AFD1 loans availed of during the Covid-19 pandemic. The R1.7 billion AIR02 bond was repaid from funds raised through the issuing of bonds between November and December 2022. Interest payments over the same period amounted to R603 million.

The Group is expected to maintain a positive cash position over the next 12 months and new debt funding will not be required during the 2025 financial year.

Credit metrics

All our covenant ratios, including the Net Debt-to-EBITDA and Debt Service Coverage Ratio, are within the threshold.

Projections for the forecast period are as follows:

| Agency | Ratings | Outlook | ||

|---|---|---|---|---|

| Rating action | Long-term local currency | Long-term national scale | ||

| Moody’s | Affirmed | Ba2 | Aa2.za* | Negative |

| Covenant | Requirement | FY 2024 (Actual) |

FY 2025 (Projected) |

|---|---|---|---|

| Credit ratings | Above investment grade BBB (national scale) | Aa1.za | A12.za |

| Net debt capitalisation | Shall not exceed 65% | 17% | 16% |

| Net debt/EBITDA ratio | Shall not exceed 4 times | 1.32x | 1.46x |

| Government shareholding | At least 50% plus one share | 74.6% | 74.6% |

| Debt service cover ratio by available cash | Not less than 1.5 times | 3.25x | 3.26x |

Credit rating

The Group’s credit rating has improved from negative in the 2023 financial year to stable in light of improved trading conditions during the reporting period.

| Agency | Ratings | Outlook | ||

|---|---|---|---|---|

| Rating action | Long-term local currency | Long-term national scale | ||

| Moody’s | Affirmed | Ba2 | Aa2.za* | Stable |

Fruitless and wasteful expenditure

Fruitless and wasteful expenditure amounted to R114 000, which was incurred due to interest on overdue municipal accounts. This was a significant improvement on the R10 million incurred in the previous period, which was due to interest on overdue municipal and supplier accounts as well as to services paid for but not received.

Irregular expenditure

The irregular expenditure incurred during the reporting period was R98 million (2023: R59 million):

- Some of the goods, works or services were not procured through a procurement process which is fair, equitable, transparent and competitive, as required by section 51(1)(a)(iii) of the PFMA.

- Some of the contracts and quotations were awarded to bidders that did not score the highest points in the evaluation process, as required by section 2(1)(f) of PPPFA and Preferential Procurement Regulation 2022.

ACSA complies with the National Treasury Irregular Expenditure Framework as updated from time to time. Compliance is monitored through the Group’s loss control function, which performs detections, assessments, determinations and investigations of expenditure transactions.

Outlook

Profitability is expected to improve during the three-year period of the current Corporate Plan, which concludes at the end of the 2027 financial year. By this time, global air traffic is expected to have reached 83% of pre-pandemic levels. In line with this, capital expenditure of R10 billion has been budgeted for over the three-year period. This has been allocated for the revitalisation of infrastructure to improve airport efficiency and elevate the user experience.

The Group continues to monitor the business environment to determine appropriate responses and to ensure long-term financial sustainability. We also continue to monitor efficiencies in our operations and to keep firm control over expenditure.

© Copyright 2024 ACSA